As the world changes, so do technology and investment options. Bridge Wealth Group, Wealthbar, and Nicola Wealth can help ease the financial stress of saving and investing. Getting ahead financially in today's world has become more challenging every day. There isn't a day that goes by where there isn't a world issue happening or some political event going on that is affecting the stock market and many of our investments.

- Is volatility the new normal?

- Should we be concerned about our investments and their volatility?

- How can we reduce the stress this puts on our lives?

I would say these are common thoughts for most people, but we do have a solution. Let me introduce Wealthbar and Nicola Wealth.

What is Wealthbar

It is an online digital technology that was formed with real advisors. Real live advisors like Bridge Wealth Group can provide easy access to long term, low-cost solutions for financial planning and investments. This technology allows us to deliver fast and efficient options to our clients. These stable investing options in Wealthbar have Nicola Wealth solutions available that previously was only accessible to high net worth individuals. The technology allows us to be competitive without having hefty desk fees and expenses like traditional advisor platforms. We then, as advisors, can provide access with lower costs to the end consumer and still provide quality long term investment solutions. Fees up to 60% less than traditional mutual funds.

The technology is easy to use and has simple investment options with reliable, stable returns. There are easy to use financial tools to help you along the way. Our advisors are available to help guide you with the personal attention you deserve.

Wealthbar - Online platform with low fees, but an unparalleled investment.

Who is Nicola Wealth Management

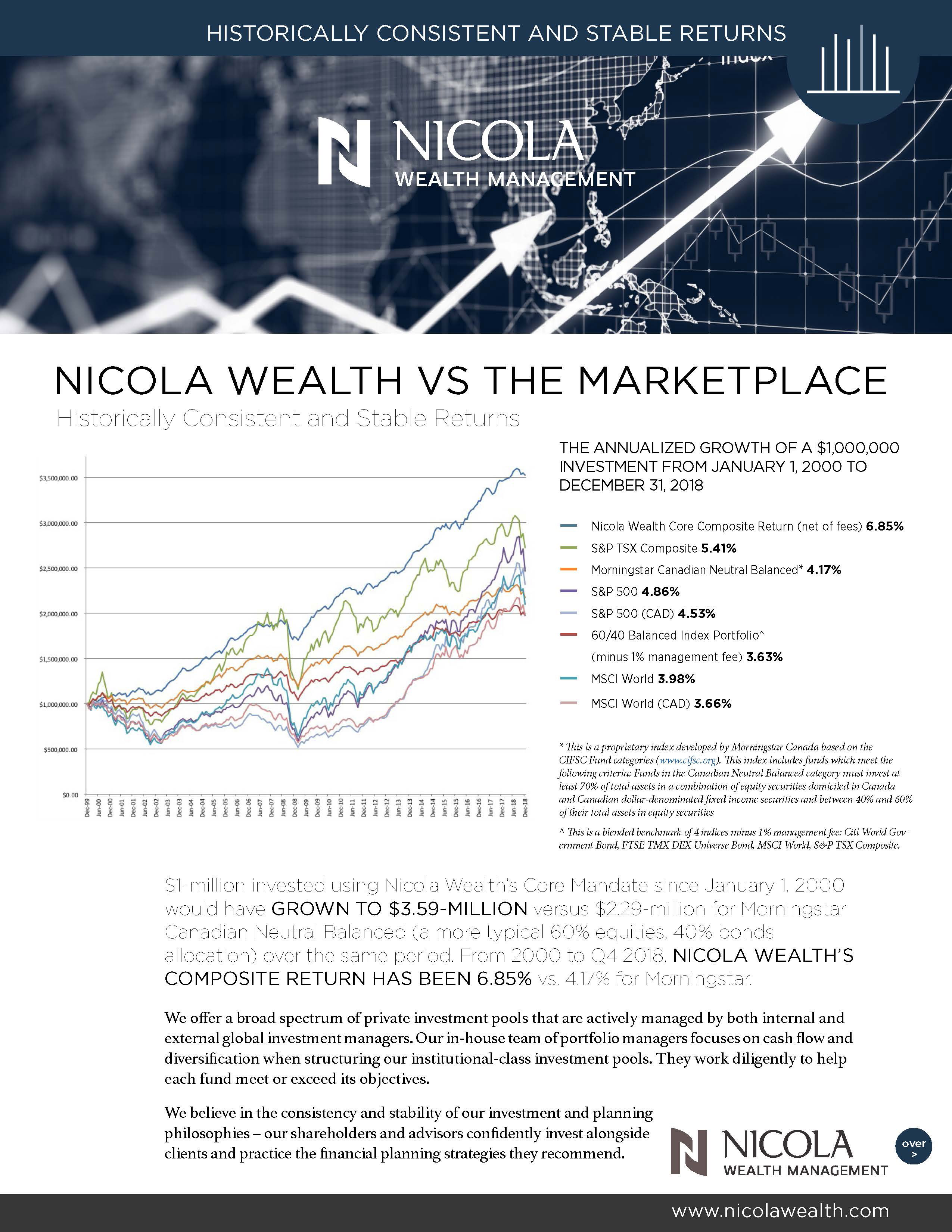

Nicola Wealth, established in 1994, now has over $5 Billion in investment assets that they manage. They are a high net worth, investment management company. Access to them was only available to business owners and high net worth individuals with large investment accounts. Their philosophy focuses on Risk Management and cash flow. Since 2000, they have returned over 7% for their clients annually with reduced volatility.

They can reduce investment volatility and increase rates of return because of their innovative investment approach that goes beyond the stock market. They have achieved excellent and stable results with investing in additional alternative investment classes such as:

- Private equity,

- Mortgages,

- Private debt,

- And institutional-grade real estate.

Tea and Chris Nicola wanted to bring innovation to Canada. This new technological world is rapidly changing, and they wanted to help make a change. They wanted to provide top-notch investment options available to any Canadian with as little as $1000 to invest. So, they built the Wealthbar technology platform to deliver their custom-built investment solutions. These investment solutions follow the same principles they use to provide robust and risk-adjusted investment returns for their high net worth clientele. These Private Portfolio Investment Options, once available only to high net worth individuals, are now accessible through Bridge Wealth Group.

What separates Nicola Wealth from other investment firms?

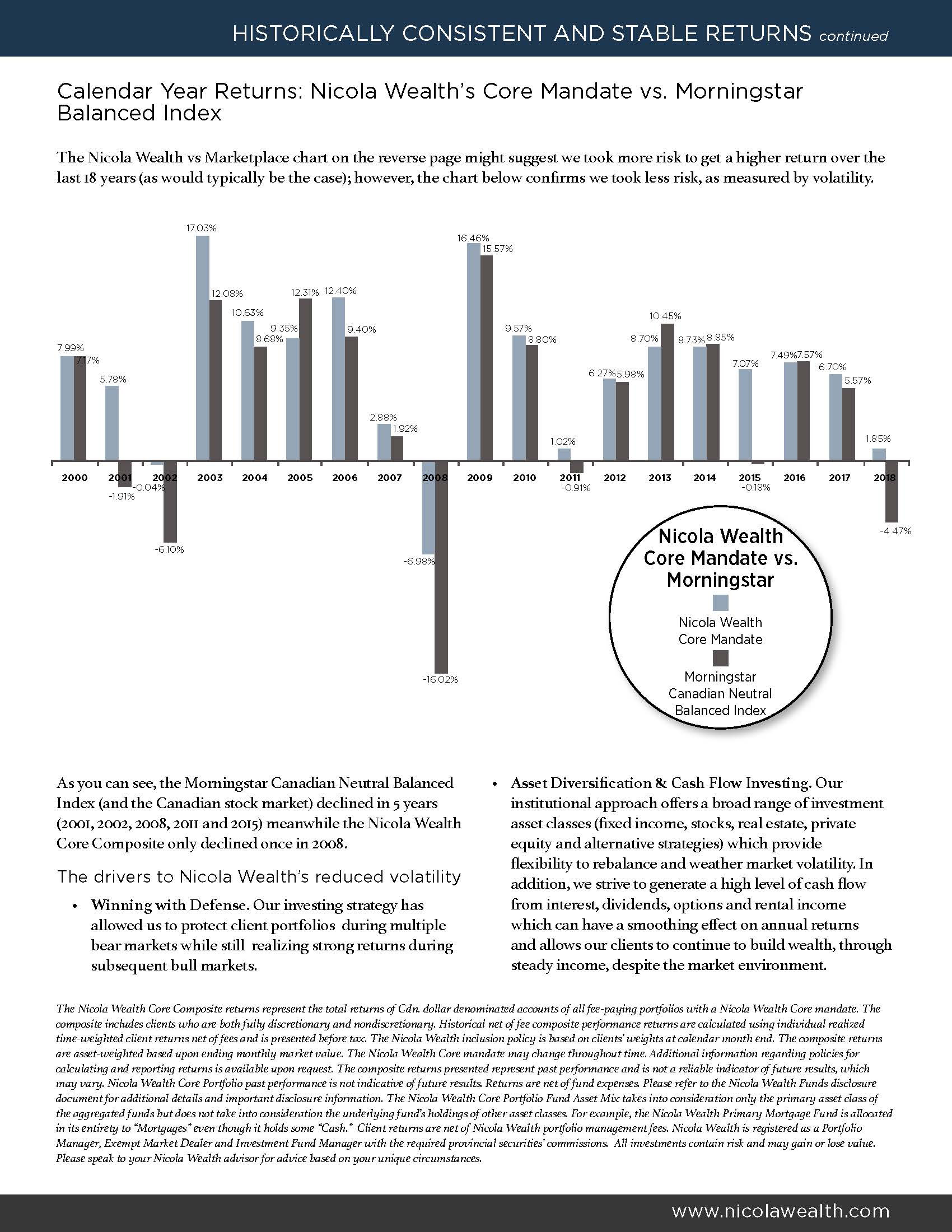

Let's look at how did they performed in 2008 during the financial crisis?

While 2008 caught many investors off guard, Nicola's clients were well balanced and diversified. They not only weathered the storm, but they were able to take advantage of the strong rebound. Their extensive diversification, not directly affected by the massive stock market swings, has helped protect the downside to -7.33% in the balanced position. Compare this to the Morningstar Canadian Neutral Balanced plan of -16.02%. Many of you might have seen investments go beyond -40%. Now we have better options that are easily accessible.

It is great to have their advice and investing skills by your side. We have had this extended bull market since 2009, and it is great to feel protected without taking on the extra risk. You might be wondering, when will the next market crash happen and how can you reduce this risk without giving up returns. The Nicola Wealth Management Team can secure this.

If you can protect the downside, the upside will happen.

Nicola returns with proven Safety.

Do they know how to invest in real estate? Yes.

Nicola Wealth Real Estate Fund has been able to capture a 16.3% return since inception. They have been able to do this with relatively low volatility.

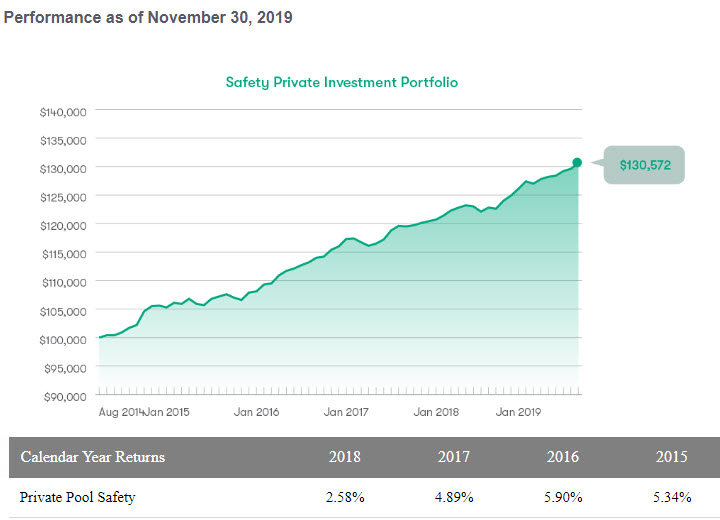

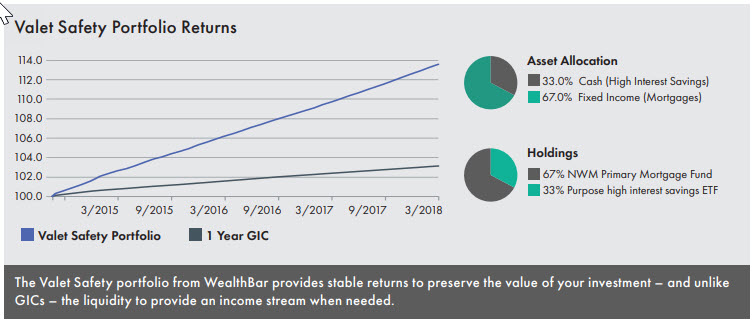

Do they know how to run a conservative program? Yes.

This chart shows the hypothetical cumulative performance of $100,000 invested in the Private Pool Safety Portfolio since the inception date of September 1, 2014. All returns are time-weighted and net of the funds’ management expense ratio (MER); however, do not display performance net of WealthBar’s management fee. Portfolio performance is not guaranteed; the value can go down and up and change frequently. Past performance is not indicative of future returns. Further disclosure can be found below.

This chart shows the hypothetical cumulative performance of $100,000 invested in the Private Pool Safety Portfolio since the inception date of September 1, 2014. All returns are time-weighted and net of the funds’ management expense ratio (MER); however, do not display performance net of WealthBar’s management fee. Portfolio performance is not guaranteed; the value can go down and up and change frequently. Past performance is not indicative of future returns. Further disclosure can be found below.

Do they know how to run a balanced program? Yes.

Nicola Wealth Core Balance Fund has been able to capture a 8.1% return since inception. They have been able to do this with relatively low volatility.

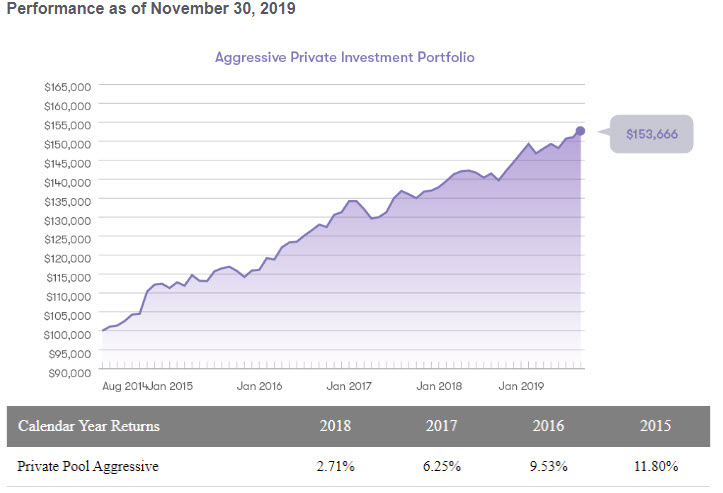

Do they know how to run a more aggressive approach for those with higher risk tolerance and more time? Yes

This chart shows the hypothetical cumulative performance of $100,000 invested in the Private Pool Aggressive Portfolio since the inception date of September 1, 2014. All returns are time-weighted and net of the funds’ management expense ratio (MER); however, do not display performance net of WealthBar’s management fee. Portfolio performance is not guaranteed; the value can go down and up and change frequently. Past performance is not indicative of future returns. Further disclosure can be found below.

This chart shows the hypothetical cumulative performance of $100,000 invested in the Private Pool Aggressive Portfolio since the inception date of September 1, 2014. All returns are time-weighted and net of the funds’ management expense ratio (MER); however, do not display performance net of WealthBar’s management fee. Portfolio performance is not guaranteed; the value can go down and up and change frequently. Past performance is not indicative of future returns. Further disclosure can be found below.

What if you want a safe alternative to GIC's? Utilize one of our Safety or Conservative programs.

Bridge wealth group has competitive and flexible alternatives to GIC"s. High Interest Savings accounts available with up to 2%. Discuss with advisor for current rates, as they are subject to change.

How can Nicola Wealth fit in your Investments?

We first need to:

- Find out more about you and your family.

- Learn more about your goals and concerns.

- Learn more about your risk tolerance and investment understanding.

Once we complete this fact-finding mission, we then can provide you suitable investment options. Let's get to know you and at the same time, you get to know us. After all, this is a long-term partnership with open two way communication.

Download our information gathering sheet to get a head start.

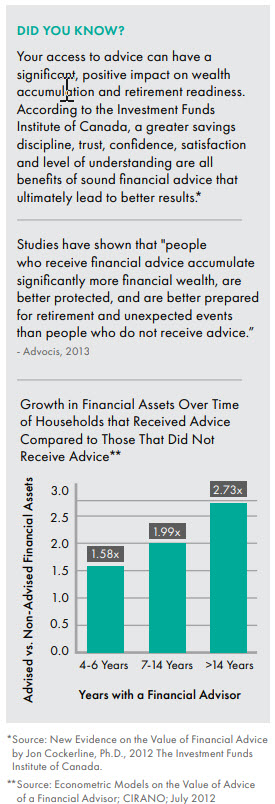

The Value of Financial Help and Advice.

Studies have shown that people who do receive financial advice do achieve more wealth. We find that they stick to a plan better, have less stress, and are better off long term.

Bridge wealth groups advice provides clear value for your long-term investing

Good things can and do happen to good people.

At Bridge Wealth Group, we have access to Nicola Wealth as a money manager investment option and use Wealthbar as the technology. Let us develop a suitable plan and get you started.

- Are you looking for safety? Private Pool Safety

- Do you want growth but limit some volatility? Private Pool Balanced

- Are you a little younger with some time on your investment life span and are okay with a higher risk tolerance? Private Pool Aggressive

What to do next for Simple and Effective Investment Solutions?

Schedule an introductory call and let's work together.

"Rest easy knowing your money is taken care of with Bridge Wealth Group, Wealthbar, and Nicola Wealth." Darrel Pendry

Darrel Pendry is the lead advisor and principal of Bridge Wealth Group and www.belifeinsured.ca. He has been providing financial and insurance advice since 2004. Currently holds insurance licenses in Alberta and British Columbia. Darrel has an extensive background and training in: mutual fund investments, exempt market products, insurance and investment coaching, insurance options for business owners, general insurance (home, auto, motorcycles, commercial businesses), and group benefits and group RRSPs.

Disclosure - These are hypothetical illustration of performance based on the current model portfolio’s holdings and weights as described, going back to inception, being rebalanced daily and denominated in Canadian dollars. All returns are time-weighted and net of the funds’ management expense ratio (MER); however, do not display performance net of WealthBar’s management fee. Clients do not pay any trading or custody fees. In addition, the model performance shown does not include any disbursements such as third-party financial planning service fee. Portfolio performance is not guaranteed; the value can go down as well as up and change frequently. Past performance is not indicative of future returns. Source: MorningStar Direct and Nicola Wealth Management. The performance provided is for informational purposes only and is not to be considered as investment advice. There may be significant differences between the investment portfolios, that are not discussed here including different investment objectives and risk factors. You should always consider, in any investment decision, your investment objectives, needs, circumstances, restrictions, tolerance for risk, financial goals and investment time frame. Although WealthBar believes the obtained information provided from third-party sources to be reliable, WealthBar does not guarantee the information and disclaims any liability associated with the use of these performance results. For full details of calculation please contact [email protected]. WealthBar is registered with Canadian securities regulatory authorities in all provinces and territories in Canada as a Portfolio Manager. WealthBar is responsible for understanding your goals, ability and willingness to accept investment risk when recommending a portfolio that is suitable for you. WealthBar and its portfolio managers have in-depth knowledge of all securities that they buy and sell or recommend for your account(s). Your portfolio manager knows each security well enough to understand and explain the risks, key features, and initial and ongoing costs and fees. Your advisor is not able to provide investment advice for your WealthBar accounts.